EMEA Insurance Information

For nearly 30 years, SNL has been the leading provider of sector-focused information in North America, and now we offer the same high calibre of intelligence for the European, Middle Eastern and African insurance markets. SNL provides a single online source for comprehensive data, news and documents on over 500 Life and Non-Life insurers in EMEA, as well as information on banks and other financial services firms. We gather data from multiple sources, including interim fillings, scrub it for accuracy, standardize it for easy comparisons, and publish it faster than any other provider.

For nearly 30 years, SNL has been the leading provider of sector-focused information in North America, and now we offer the same high calibre of intelligence for the European, Middle Eastern and African insurance markets. SNL provides a single online source for comprehensive data, news and documents on over 500 Life and Non-Life insurers in EMEA, as well as information on banks and other financial services firms. We gather data from multiple sources, including interim fillings, scrub it for accuracy, standardize it for easy comparisons, and publish it faster than any other provider.

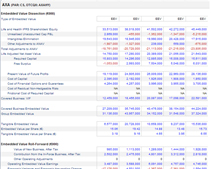

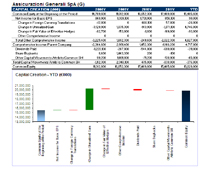

SNL's EMEA insurance coverage provides extensively-vetted, comprehensive information on embedded value, solvency, new business, investments and a lot more; as well as traditional, insurance focused IFRS P&L and balance sheet templates. SNL performs all currency conversions and language translations, saving you valuable time.

Simplify your analysis of the complicated EMEA insurance markets

Our standardized data cleans up irregularities and eliminates time consuming manual data collection. Plus, our numbers link right back to the original source documents for easy auditing. Find an error, and we'll reward you $50. That's why top insurance executives, investment banks, money managers and legal professionals all rely on SNL's unmatched expertise, and why over 95% of SNL clients renew their subscriptions every year.

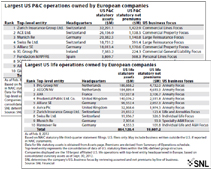

- Dissect insurance companies' operations between Life and Non-Life;

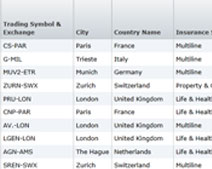

- Easily perform cross border analysis;

- Analyze the quality of insurance companies' investment portfolios;

- Dive into embedded value financials through our heavily vetted templates;

- Assess the solvency of an insurance company;

- Create accurate recommendations with detailed financial data on the Lloyd’s market.

Access over 800 data items in a standardized, insurance-specific IFRS template. Simplify European reporting inconsistencies and make cross country comparisons easy. Find detailed information on:

- Underwriting analysis both on the Life and the Non-Life operations

- Income statement, with standardized operating profit

- Detailed embedded value analysis, including the methodology applied

- Life new business metrics (regular premiums, single premiums, APE, new business IRR, and payback period)

- Solvency II ready capital template, with a reconciliation of IFRS equity to the reported available financial resources, and a standardized breakout of the required capital

- Standardized ratios – everything is comparable for benchmarking, screening and peer analysis

- Pre-formatted snapshots to analyze insurance companies in the way an industry analyst or actuary would

- Integrated information from a wide variety of sources from one launch pad

- Credit ratings from leading ratings agencies

- Single source for all company documents, collected from company websites, regulatory bodies and stock exchanges:

- Annual, interim and quarterly reports

- Earnings, M&A and other investor presentations

- Embedded value reports

- Conference call transcripts

- Debt and equity offering data and prospectuses

- Earnings and other press releases

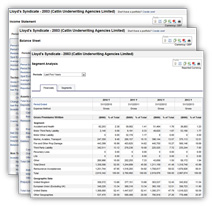

SNL's Lloyd's syndicates coverage provides detail into the structure and financial performance of the current active Lloyd's syndicates and Lloyd's market:

- Over 170 data points available online or via Excel

- Standard templates for all syndicates allow for easy comparisons

- Understand counterparty risk, composition and performance across the Lloyd's market

- Easily identify groups with a Lloyd's presence and trace their relationships with Managing Syndicates, Managing Agents and Insurance Groups

- Annual syndicate disclosure PDFs

- Historical data since 2009

SNL's Peer Analytics offers innovative default peer logic and powerful customization options, allowing you to easily measure yourself against your peers. Within Peer Analytics you can:

- Create relevant peer comparisons using SNL's proprietary score & rank functionality

- Customize your peer reports by selecting from a wide range of fields such as Tangible Equity, Net Income, ROAE and Total Policy Income

- Leverage your saved peer groups within the rest of SNL

SNL provides M&A data and equity offerings, including detailed deal comps. Our comprehensive capital structure and M&A data helps you:

- Drill down to specific company debt or equity issues and view a company's debt maturity schedule

- Track M&A transactions geographically, analyze synergies and perform deal scenario mapping

- Review company merger and capital-raising histories

Available data includes:

- Market growth and penetration

- Business lines and technical performances in Life and P&C

- Major players

- Market shares in major business lines

- Details about investment portfolio and distribution channels

- M&A History

- Up to 10 years of historical data

- The Daily Dose summarizes all of the significant news stories from Europe’s major publications, published at 8:00 am London time, every business morning.

- Access reference publications on the European insurance industry: Insurance Insider and Insurance Insight

- In-depth proprietary reporting that provides timely insight into industry trends and regulation

- Portfolios allow you to pick the companies that most interest you and receive alerts and summaries of their latest developments

SNLxl, our powerful Excel add-in, allows you to seamlessly integrate SNL financial and market data into your spreadsheets and models.

- Build your own template once, then update it at the touch of a button whenever we update our database.

- Create your own customized spreadsheets.

- Tap into our extensive library of pre-built templates.