Financial Services Company Information

SNL provides 360-degree

coverage of the financial services industry. Many portfolio managers use SNL as

their exclusive, one-stop information provider for one or more of the 6 sectors

SNL covers. Whether you're a sector specialist or a generalist, SNL's sector-specific

formats, fields and financials give you the most relevant views.

SNL provides 360-degree

coverage of the financial services industry. Many portfolio managers use SNL as

their exclusive, one-stop information provider for one or more of the 6 sectors

SNL covers. Whether you're a sector specialist or a generalist, SNL's sector-specific

formats, fields and financials give you the most relevant views.

Serving and covering the financial services community.

Industry leaders make SNL their preferred source for complete, accurate and timely

financial data on financial services companies. Cross-sector coverage

has a dual purpose: to vet external investments or acquisition opportunities and

to benchmark internal performance against your peers. SNL offers detailed financial services information, which includes news, investor presentations and transcripts, for the following types of firms:

- Asset Managers (11,000+ public and private)

- Broker/Dealers (4,700+ public and private)

- Exchanges (NYSE Euronext, NASDAQ OMX Group, CME Group, TMX Group, Intercontinental Exchange)

- Specialty Lenders (6,500+ public and private)

- Mortgage REITs (40+ SEC filers)

- Business Development Companies (3 SEC filers)

- Financial Technology Companies (100+ SEC filers)

Data, news and analytics are cross-linked.

Dozens of preformatted snapshots show you financial trends, M&A

activity, business profiles and market share. Breaking news items and historical

archives all have links to relevant company profiles, articles and reports. Make

meaningful peer comparisons, perform in-depth analysis and generate customized reports

using a point-and-click menu. Set up your own proprietary models and link them to

the SNL database.

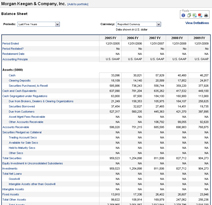

SNL provides full Balance Sheet data and Regulatory Capital data for its covered universe of nearly 5,000 private broker/dealers.

- Get a full breakdown of assets and liabilities

- Assess counterparty risk and credit quality

- Benchmark and analyze brokers' liquidity

- View income statement highlights, back to 2000Y.

- Analyze brokers' regulatory capital requirements and levels for multiple companies across multiple periods

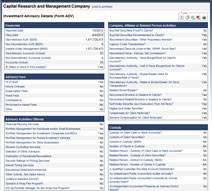

SNL provides Form ADV data that is updated twice a year. Form ADV is a filing used by investment advisors to register with the SEC or state authorities and amend those registrations. All companies that qualify as institutional managers, with at least $25 million in assets under management, are required to file Form ADV annually.

- View discretionary and non-discretionary AUM and number of accounts

- Determine the client profile for each advisor

- Find out which advisors are affiliated with banks, pension consultants, broker/dealers and other company types

- Break down an investment advisor's compensation structure

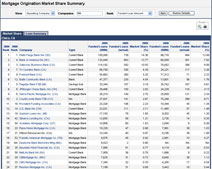

SNL provides the latest Home Mortgage Disclosure Act (HMDA) data. The Home Mortgage Disclosure Act requires depository and non-depository lenders to collect and publicly disclose information about mortgage loans and applications. The data includes applicant/borrower characteristics, action taken on the application and application amount.

- View market share for any U.S. lender

- View market share data by state, county or MSA.

- Access statistics on the loan type, purpose of the loan, and the applicant race for available markets

- Compare data for operating companies vs. top-level companies.

SNL's Peer Analytics offers innovative default peer logic and powerful customization options, allowing you to perform the most complete analysis for any U.S. public financial services company. Within Peer Analytics you can:

- Create relevant peer comparisons using SNL's proprietary score & rank functionality

- Customize your peer reports by selecting fields such as Total Enterprise Value, ROAA, ROAE, EBITDA, and Return on Average AUM.

- Add SNL indexes or custom aggregates for additional benchmarking

- Leverage your saved peer groups within the rest of SNL

SNL uses a number of sources to detect deal activity, including press releases and documents such as Forms 10-Q, 10-K and MP. SNL also produces complete, sector-specific league tables.

- Termination fees and lockup agreements

- Cost savings and restructuring charges

- Deal accretion/dilution and regulatory/shareholder approvals - Advisers and adviser fees

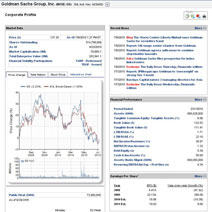

Get a snapshot summary on any company in the industry – public, private or historical. Export into PDF or Excel format.

- SEC-standardized and As-Reported financial data, including core financial statements, assets under management mix and flow data, long and short securities and client assets breakouts for brokerages, owned and managed loan portfolio data, asset quality and charge-off data, debt maturity and analysis, investment breakouts and more.

- Company description and corporate structure

- Officers and compensation

- Stock charts and insider activity

- Research reports

In addition to the breaking news accessible 24/7 on its online platform, SNL offers different newsletter titles for the financial services industry:

- Financial Services Daily: Comprehensive daily coverage of the financial services and technology sectors.