Community Bank Financial Reports

If you thought SNL serves only larger financial

institutions, think again. The leading provider of business intelligence for money

center and regional banks is an indispensable resource for community banks as well.

SNL can help strengthen community banks in 6 major ways:

If you thought SNL serves only larger financial

institutions, think again. The leading provider of business intelligence for money

center and regional banks is an indispensable resource for community banks as well.

SNL can help strengthen community banks in 6 major ways:

1. Evaluate your balance sheet relative to peers.

Assess your institution's performance relative to your peers in areas such as deposit

mix, loan mix, liquidity, asset quality and capital management.

2. Grow revenue and manage expenses.

SNL helps you compare your institution's performance to your competitors

and peers against a range of benchmarks on net interest margin, yields/cost of funds, non-interest income, and non-interest expense.

3. Optimize your branch footprint and marketing strategy.

SNL provides a comprehensive database of information you need to target, evaluate

and refine your branch network and marketing initiatives.

4. Assess potential acquisitions.

The SNL Merger Model leverages SNL's financial and M&A data on the bank and thrift

sector to enable detailed analysis of potential mergers and acquisitions

.

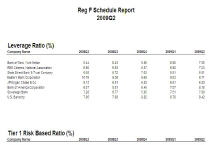

5. Streamline preparation of board/investor presentations and regulatory reports.

SNL's reporting tools significantly reduce the time necessary to prepare board and investor presentations, as well as quarterly community bank financial reports required by regulators, such as Reg F.

6. Manage shareholder expectations.

SNL's IR Solutions service is your single resource for investor relations from Web

site hosting and management to communications and corporate governance.

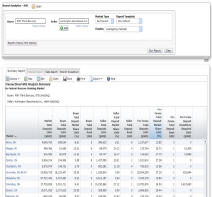

SNL's peer analysis tools let you compare your performance against your peers on a wide range of performance metrics

- Evaluate your institution's performance relative to your peers in areas such as asset quality, earnings growth, and loan and deposit mix

- Conduct analysis of key ratios utilizing SNL's pre-established peer groups for your institution or build your own custom peer groups

- Leverage our library of pre-built Excel templates that will help you save time in identifying opportunities to improve your institution's performance

- Compare your performance to asset-based aggregates matching UBPR classifications

- Access SNL's Peer Analytics platform to further customize your peer groups and reports. Use our proprietary score & rank feature to create relevant peer groups

- Model pro forma companies with our Merger Model and HHI analysis tools

- Conduct sensitivity analysis of various deal assumptions and evaluate capacity to pay at various levels of accretion or dilution

- Determine your pricing strategy by leveraging our comprehensive M&A database on deal terms and pricing ratios for whole company, branch, and government-assisted deals

Harness SNL's powerful branch database to create customized reports and professional-quality maps.

- Review the attractiveness of new and existing markets by leveraging our comprehensive database of bank, thrift, and credit union branch locations, including historical deposit and market share data

- Identify and prioritize opportunities to open new branch locations or consolidate existing facilities utilizing our sophisticated mapping tool with satellite imagery

- Enhance your understanding of market characteristics (e.g., population growth, household net worth) by leveraging our demographic data on consumers and businesses

- Generate detailed branch maps with overlays of competitors and demographic variables

SNL's reporting tools significantly reduce the time necessary to prepare reports required by bank examiners and presentations for board and investor meetings

- Complete the required Reg F reports on your correspondent banks with an easy-to-use Excel template that can be quickly updated each quarter

- Build reports in Excel to monitor the financial performance and capital adequacy of the broker/dealers with whom you do business

- Utilize SNL's Excel add-in module to create tables and charts for board and investor presentations comparing your institution's performance to peers on key metrics

For community banks, SNL is the clear choice for online investor relations, providing banking-specific exclusives unavailable from any other provider.

- SNL's banking data is integrated into your IR site

- A bank branch locator and annual performance graph are free extras

- Leading-edge IR console makes site administration easier

- Client support reps are banking experts

- You get a custom design that matches your corporate site, with free site redesigns upon request

SNL provides community banks with exceptional client support, including:

- 24/7 support availability by email or phone

- A support staff who understands your business

- Unlimited free training in person, by phone or via Webcast

- A dedicated account manager

Visit our Support/Training page to learn more about our outstanding customer service. Then visit our Testimonials page to read our clients' rave reviews.