Credit Unions

SNL gives credit unions the same advantages the biggest financial institutions enjoy. SNL has become an essential -- and affordable -- resource for more than 600 credit unions that rely on SNL for the timely data and analytical tools they need to outperform the competition and drive membership growth.

SNL gives credit unions the same advantages the biggest financial institutions enjoy. SNL has become an essential -- and affordable -- resource for more than 600 credit unions that rely on SNL for the timely data and analytical tools they need to outperform the competition and drive membership growth.

A single solution for comprehensive intelligence on the credit

union sector.

SNL is the only information provider that provides an all-inclusive package of credit union industry data, news coverage and analytical tools on an online platform that's easy to use.

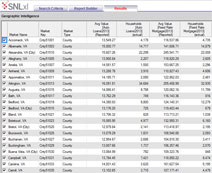

We deliver quarterly credit union financial data within 48 hours of the NCUA filing. SNL's database includes detailed profiles on more than 20,000 U.S. financial institutions, including all publicly-traded banks and thrifts, privately held institutions and credit unions, as well as their branches.

The tools to you need to grow revenue, improve performance and

make better decisions.

SNL's in-depth coverage of industry metrics facilitates insightful peer comparisons.

Leverage branch network and demographic data to maximize membership growth. Our

exclusive news coverage brings you the latest national, regional and local financial

industry developments to help you put your institution's performance within context.

Guaranteed accuracy. Free and unlimited training.

SNL is the only information provider with a 100% accuracy guarantee. All of SNL's

data is thoroughly vetted, scrubbed and standardized, so you never have to second-guess

anything you find in our database. If you manage to find an error, we'll reward

you with a gift of $50. Furthermore, clients have free around-the-clock support

and a dedicated account manager who knows the credit union industry inside and out.

Gain competitive intelligence and refine your pricing strategy with unlimited access to rate data on 50+ standard products, including mortgages, consumer loans, deposits and credit cards for credit unions and banks across the U.S. One-click reports put valuable competitive intelligence at your fingertips so you can develop strategies to build deposits, increase loan market share and expand your margins.

Reports include:

- Ranking Report: See where you stack up in the marketplace by ranking your institution against your competitors' rates for deposit and loan products

- Scatter Chart: Get a panoramic view of your market by visualizing how your rates correspond to terms and tiers for other competitors in your market

- Rate Specials: Monitor the special offers available from your competitors, with details on specials, relationship pricing, teaser rates and other promotional offers

Improve key performance and balance sheet ratios with peer benchmarking. SNL’s tools for peer analysis let you quickly compare yourself against your credit union or community bank peers.

- Choose from hundreds of predefined regional or state peer groups, or create your own customized peer groups.

- Leverage a common database of metrics that are similar across the Bank Call Report and Credit Union 5300 for apples to apples comparisons.

- Use standard fields or select from over 10,000 data points (ROAA, net worth/total assets, delinquent loans/total loans, net interest margin, NPAs/assets, number of members, etc.)

- Instantly visualize the results via 65+ easy-to-use peer charts

In minutes, prepare regulatory or board reports that used to take days. It's simple with SNL’s pre-built credit union-specific Excel templates, which refresh easily when we update our database. No more searching multiple sources. No more manual entry.

- The Financial Performance Report template presents a 5-period picture of the financial trends and operating results for a credit union, alongside a preset or custom groups of peer credit unions to help you identify trends in performance over time.

- The Credit Union Tear Sheet template provides a one-page profile for a credit union with financial highlights, balance sheet and income statement

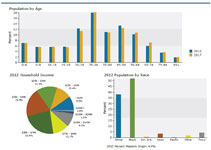

Evaluate your branch network and optimize it based on geographic, demographic and financial factors. SNL gives you instant access to detailed demographic data on both households and businesses. SNL’s Nielsen Financial Product Demand data allows you to evaluate a market's demand for over 100 financial products and services such as checking accounts, mortgage products, or internet banking.

- Increase marketing campaign effectiveness by targeting markets based on financial product demand

- Enhance your understanding of market characteristics (e.g. population growth, household net worth)

- Assess the business landscape with individual business listings and aggregated business statistics such as estimated retail sales, total number of employees and businesses counts

Harness SNL’s powerful branch database to create instant professional-quality maps of your branch network and that of your competitors.

- Evaluate the attractiveness of new and existing markets

- Track credit union deposit growth vs. that of banks and thrifts on a retail basis

- Plot competitive tactics and optimize branch footprint

- Create presentation-ready maps

Rely on SNL’s news coverage up-to-the-minute news and detailed analysis of budding trends in the credit union and banking industries. Get valuable commentary on regulatory developments, deals, interest rates, capital markets activity, executive moves and more.

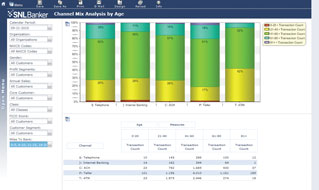

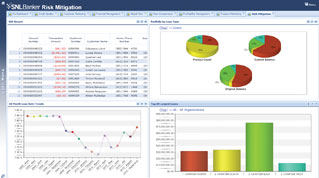

SNL Banker is a new single-source for internal analysis, integrating your credit union's data for a 360° view into finance, credit & risk, operations and sales & marketing. Gain the insight needed to maximize performance, reduce risk and increase efficiency.

Pricing pressures, regulatory demands, Inefficient reporting processes all add add to the challenge of running a successful credit union that is profitable, compliant with changing regulations and provides a high level of customer service. Regulators, members and employees are all fighting for your attention. Even in this digital age, it’s nearly impossible to stay connected to it all. SNL Banker is your streamlined solution for efficient reporting and business intelligence.