SNL Mine Economics

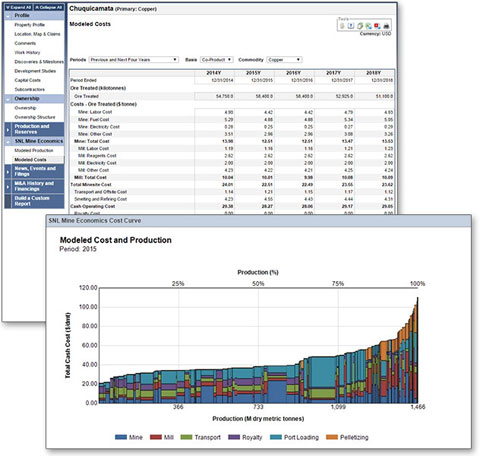

Standardized, detailed mine cash flow models and comprehensive global cost curves provide the 360° view required to develop fully-informed business development and investment strategies.

SNL Mine Economics data is carefully gathered and analyzed by our team of experts, and then integrated into our online database and Excel add-in. Data standardization and detailed model notes give clients a transparent view of the underlying analyst assumptions, sources and methodology.

Our ever-expanding mine cost coverage includes the majority of global production for each metal with historical data from 1991 and forecasts and estimates for the next 25 years. Coverage includes: iron ore, copper, nickel, lead, zinc, molybdenum, platinum, palladium, rhodium and uranium with plans to add cost curves for gold in the near future.

Using SNL Mine Economics, clients are able to:

- Quickly see how one mine compares to another based on a wide range of production and cost parameters with an easy-to-use dynamic charting interface.

- Understand the risk of commodity prices and take preemptive action to mitigate the scale and impact of losses should prices fall.

- Act ahead of the market based on reliable forecasts for which you can drill down into the affecting factors.

- Present to investors and boards of directors with confidence, showing a given property's outlook compared to others on the curve.

- Identify opportunities for increased operational efficiencies at a mine by examining costs of labor, power, milling, smelting/refining, transport, royalties, fuel and consumables.

- Export raw data to Excel including detailed production and cost metrics with the ability to filter based on select criteria.