SNL Real Estate's quarterly NAV Monitor is a net asset value (NAV) report

for both U.S. REIT and global property companies. In addition to this valuable market

analysis, SNL is also a provider of data, news and analytics that industry experts

rely on for the most accurate and timely information in the marketplace.

Below are examples of this important analysis compiled by SNL with real estate data

from across the globe. For more information contact sales@snl.com; +1.866.296.3743

(Americas); +44.20.7398.0873 (Europe and rest of world).

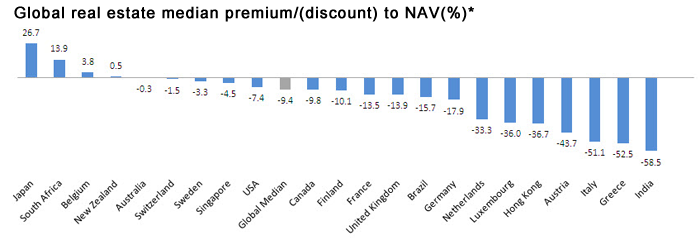

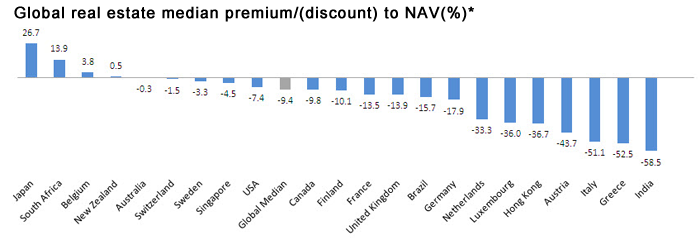

Net asset value (NAV) data is typically reported by property companies in most countries in Europe and Asia, primarily due to widespread adoption of fair-value accounting and International Financial Reporting Standards. Different levels of independent appraiser involvement are used in producing these estimates, depending on the precise regulatory regimes. In theory, fair-value reporting provides additional transparency to markets as investors can look at the externally appraised value of the real estate assets held by a company on a per-share basis and compare that with the current share price to get a sense of whether shares are overpriced or underpriced.

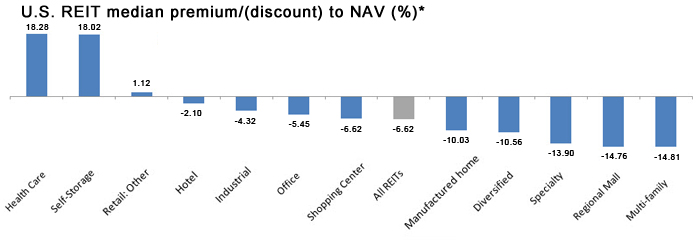

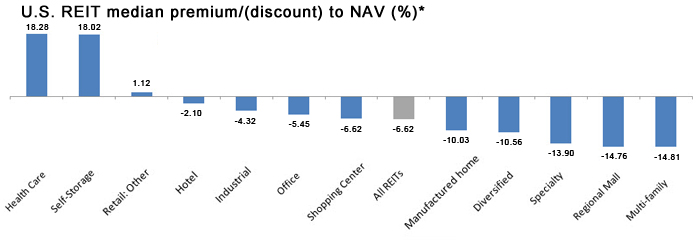

Data on U.S. REITs come from net asset value (NAV) estimates made by sell-side equity research analysts typically working for investment banks. SNL collects these estimates and calculates a median for each of the companies. U.S. and Canadian GAAP require that companies report the value of their properties at historical cost, so the companies themselves are not required to provide an estimate of NAV to the market. In calculating a company's premium or discount to NAV, one looks at two figures: the company's share price and its NAV estimate. Historical data suggest that U.S. REITs tend to trade in a range of a 20% premium to a 20% discount to the NAV estimate.

Net asset value (NAV) data is typically reported by property companies in most countries in Europe and Asia, primarily due to widespread adoption of fair-value accounting and International Financial Reporting Standards. Different levels of independent appraiser involvement are used in producing these estimates, depending on the precise regulatory regimes. In theory, fair-value reporting provides additional transparency to markets as investors can look at the externally appraised value of the real estate assets held by a company on a per-share basis and compare that with the current share price to get a sense of whether shares are overpriced or underpriced.

Net asset value (NAV) data is typically reported by property companies in most countries in Europe and Asia, primarily due to widespread adoption of fair-value accounting and International Financial Reporting Standards. Different levels of independent appraiser involvement are used in producing these estimates, depending on the precise regulatory regimes. In theory, fair-value reporting provides additional transparency to markets as investors can look at the externally appraised value of the real estate assets held by a company on a per-share basis and compare that with the current share price to get a sense of whether shares are overpriced or underpriced.